Providing long term for a disabled person also involves considering social security implications.

A Special Disability Trust can enable a considerable financial provision to be made for a disabled person without impacting social security entitlements

What is a special disability trust?

A Special Disability Trust (SDT) is a trust established primarily for the current and future care and accommodation needs of a person with a severe disability or medical condition.

Established initially by the Howard Government, the primary benefit of Special Disability Trusts are that assets within the trust do not affect either:

- The pension entitlements of the disabled person for whom the trust amounts are held; or

- The asset test requirements relating to the pension of the person establishing the trust, in particular, the alienation of assets rules relating to the aged pension.

The SDT is established to pay for any care, accommodation, medical costs and other needs of the disabled beneficiary during their lifetime.

Why establish a Special Disability Trust?

Planning for the future of a person with high-support needs requires consideration of how the person would be provided for or how their quality of life may change if providers within their family pass away or enter retirement.

These life events sometimes provide an opportunity to the well-advised that may turn one-off lump sums into sustainable assistance for years to come.

Social Security and Taxation Benefits

For a Special Disability Trust to be established, the beneficiary must be ‘severely disabled’ (usually, receipt of a disability pension will indicate this) and the trust deed establishing the trust must comply with the requirements of a SDT.

If these criteria are met then SDTs attract concessional treatment under social security means-tests for both the person with a severe disability and contributing immediate family members when they or their partner turn ‘Age Pension’ age. Some of the other benefits of a Special Disability Trust are:

- that a gifting concession of up to $500,000 (combined) is available for eligible family members of the principal beneficiary: and

- that an assets test assessment exemption of up to $669,750 (indexed each year) is available to the principal beneficiary; and

- the unexpended income of the trust is taxed at the beneficiary’s personal income tax rate, rather than at the highest marginal tax rate.

In life or death

A SDT may be established to operate at any time. It is also common for parents or other relatives of a disabled person to gift the inheritance intended for that person into a Special Disability Trust administered by the executor of the estate.

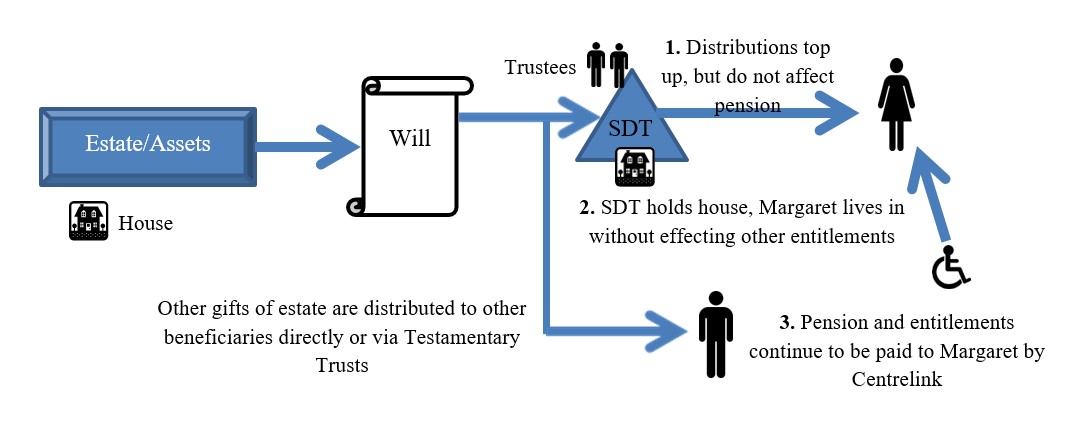

Example – Special Disability Trust in a will

Margaret has severe physical and intellectual disabilities and is eligible disability pension recipient. Her mother, Christine decides to establish a Special Disability Trust for Margaret and considers whom she can appoint as the trustees for Margaret’s trust.

Christine decides to place Margaret’s inheritance into a Special Disability Trust and appoint her other two children as trustees due to their close involvement with Margaret. Christine anticipates that they will each bring their own view to the table and be able to administer the SDT for Margaret’s benefit, particularly given the terms of the trust ensure that Margaret is the only person able to benefit from the trust during her lifetime.

The other beneficiaries of the estate receive the portion of the estate that is their inheritance separately or in a Testamentary Trust. (See our information sheet on Testamentary Trusts for further information)

The Special Disability Trust has the following advantages:

- Margaret continues to be eligible to receive her disability pension and health-related benefits, notwithstanding that signifcant assets have been set aside for her sole benefit.

- The house, transferred to Margaret’s trust, provides a familiar and safe environment for Margaret to reside in or as a source of income in the future. The house continues to be eligible for ‘Principal Place of Residence’ and other tax concessions notwithstanding it is held in the Special Disability Trust.

- Income may be used for the care and accommodation needs of Margaret, or for any other purposes deemed appropriate by the trustees to an annual limit.

Contact Us

Need more information or want to book in a time to talk with one of our experts? Just fill in the form below and we'll get back to you.

Further Resources

NDAs and Contamination

Latest Videos

Businesses that we have helped

Here's a small selection of businesses we've helped achieve great outcomes.

As Featured In: