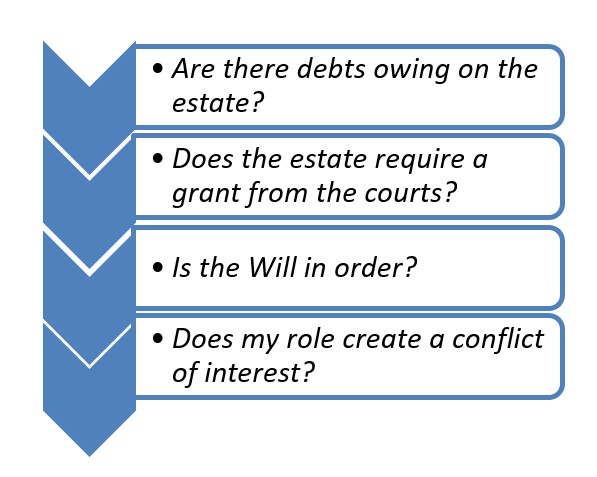

When it comes to being an executor there are things you should be aware of…

…are there debts owing on the estate?

…does the estate require a grant from the courts?

…is the Will in order?

…does your role cause a conflict of interest?

In a rapidly ageing population, many people will have the experience of acting as the executor and trustee of an estate. As a role with specific duties and responsibilities, including to beneficiaries of the estate and to the Court, it is essential to be aware of those obligations over the course of the administration process.

The role of executor

The executor is primarily responsible as the deceased’s legal personal representative to collect all the assets of the deceased and hold them on behalf of beneficiaries.

The executor has to pay any debts, legacies under the will and then eventually distribute the remainder or ‘residuary estate’ amongst the beneficiaries in strict accordance with the terms of the will.

Obtaining a Grant

By obtaining a grant of probate from the Supreme Court, the executor is authorised to administer the estate, however it should be noted that this is not always essential.

In the event that there is no will the estate is said to be ‘intestate’ and an application to the court must be made for a grant of letters of administration.

It should be noted that various family members can also apply to get such a grant, but some may have priority to others. Where the deceased dies intestate, the relevant legislation will provide how the estate is to be divided.

Mortal remains

It is the duty of the executor to organise and arrange the burial or cremation of the deceased. This can be particularly relevant where there are disputes within the family over which method is more appropriate.

Wishes of the deceased

A common practice in contemporary estate planning is the drafting of a letter of wishes. This informal document provides guidance and information to the executor to inform their decisions. An executor benefits greatly from having a clear objective and instructions as to the deceased’s final wishes. While there is no set form, letters of wishes often include distribution of small gifts such as jewellery or trinkets, gifts to third parties or funeral directions.

Record management

It is the responsibility of the executor to maintain proper financial records that reflect the estate management and administration. It is essential that all record management is scrupulous as they may be required in court.

Disputes and Claims

An executor may obtain protection against claims by obtaining a grant of probate of a will and carrying out its terms.

There are a number of timeframes that are relevant to administering estates, such as timeframes for notice of, or bringing claims against an estate (which vary from state to state). These timeframes may inform an approach to reduce incentive for claims or to reduce risk for the executor.

The executor should collect all assets including debts payable to the estate as quickly as possible. This may also include commencing proceedings against a third party to obtain a debt owing or an asset. If an executor delays in collecting assets of the estate, they may be personally liable for legacy interest or losses.

Obligations to creditors

It is the responsibility of the executor to pay the lawful debts of the deceased. Creditors of an estate paid out of the assets of the estate. Failure to pay creditors may in some circumstances result in liable for payment of those debts.

Executors Commission

Executors may be eligible for commission for carrying out their duties to the estate. For individuals not acting in a professional capacity, the commission is usually determined in terms of a percentage of the capital and income of the estate. However, the Court determines the amount of remuneration that applies, taking into account the amount of work the executor has done and the circumstances. A deceased’s Will may also outline how much an executor is to receive for executor’s services.

Avoid conflict of interest

Often executors are also beneficiaries or in some instances creditors to an estate. While this may appear to be a conflict of interest, most courts are generally reluctant to interfere with the will maker’s decision to nominate an executor; as such a perceived conflict would have been obvious and known by the testator when the will was made.

Acting in the role before obtaining a grant

The entitlement of executors to act derives from a will, which is confirmed by the Court when it makes a grant. This entitlement commences from the date of death, however if there is no will, the entitlement commences from the date of when a Court grants letters of administration.

Removal of executor

In the event that an executor loses their position of power whether from mental incapacity; injury or is convicted of a crime, a court will assist with the administration of a deceased estate.

A Court may also revoke a grant of probate and instead provide instructions for the administration of an estate under civil procedure rules. Revocation usually occurs if there are instances of fraud, mistake, or where administration of the estate is in jeopardy.

Timeframes

The executor administers the estate and distributes the assets within a reasonable period of time, usually considered to be within a year.

An executor may be called upon to explain and justify the delay if the administration surpasses a year.

Conclusion

Accepting the role of executor brings great powers and responsibility to a family estate. There are burdens and risks involved, and an individual can renounce the role before a grant is issued. While the executor’s role is to administer the deceased’s wishes, there is significant capacity for him or her to affect the position of the beneficiaries and vice versa for a long time.

Contact Us

Need more information or want to book in a time to talk with one of our experts? Just fill in the form below and we'll get back to you.

Further Resources

NDAs and Contamination

Latest Videos

Businesses that we have helped

Here's a small selection of businesses we've helped achieve great outcomes.

As Featured In: