Placing significant property in its own separate entity (like a company or trust) is a common and effective way to protect assets and manage risk. It also gives the owner more options for managing the assets and estate planning.

This can be easily done if the separate entity exists at the time of purchase. It can be more complicated if a person already owns the property in their own name. Transferring the asset from person to separate entity can incur stamp duty and capital gains tax. There’s also the potential for an administrator to seize the asset under bankruptcy or insolvency laws.

One popular method used by persons who already own property is the ‘gift-and-loan-back’ strategy.

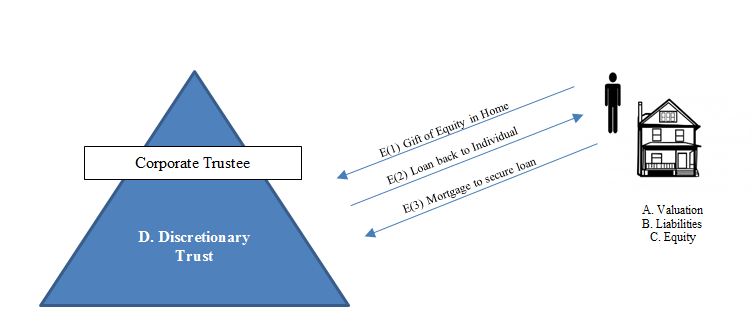

How it works

A. The owner determines the value of the asset they want to protect. The owner can research the value themselves, or they can engage a valuer to provide a report.

B. The owner determines the liabilities attached to the asset. For example, the asset might be a block of land that has a mortgage. The mortgage might secure a bank loan for $100,000. That asset’s liability is $100,000.

C. Subtracting the liabilities of the asset from the value of the asset gives the “equity” in the asset. This is how much the asset is worth to the owner.

D. The owner establishes a separate entity – either a company or a trust. The entity is set up so that the owner has complete control and so that the entity can give property and money back to the owner.

E. The owner prepares three documents:

(1) A “deed of gift”. This agreement has the owner give the separate entity an amount equal of money to the equity in the asset. This is the “gift” in “gift-and-loan-back”.

(2) A “loan contract”. This agreement has the separate entity loan the owner an amount of money equal to the equity in the asset. This is the “loan back” in “gift-and-loan-back”.

(3) A “mortgage” or “security agreement”. This agreement puts a charge over the asset as security for the owner repaying the loan to the separate entity. If the owner fails to repay the loan, the separate entity can take the mortgaged or charged asset.

A gift-and-loan-back with a house as the asset and a discretionary trust as the separate entity would look like this:

The asset remains in the name of the original owner. However, the equity of the asset belongs to the separate entity. And, if necessary, the entity can secure that equity by seizing the asset under the mortgage or security agreement.

Because the asset itself has not been transferred, the strategy does not incur transfer duty or capital gains tax.

The owner has protected the equity in the asset in two ways:

- During your lifetime, the equity in the asset is protected from the risk of third party claims against you – any third party claimant would need to satisfy the secured debt to the trust before obtaining a benefit from the asset.

- Upon your death, control of trust would pass to your executors. Your beneficiaries would have the benefit the asset with minimal risk of a claim against the asset.

It is important to be aware of the limits of a gift-and-loan-back. Two significant restraints are:

- Relationship breakdown. A gift-and-loan-back will almost certainly not protect the asset from the owner’s spouse (married or de facto). The Family Law Act considers assets in trusts controlled by a spouse to be marital property.

- The amount of equity protected is limited to the amount formally gifted and loaned back. It can be ‘topped up’ from time to time as the value of the protected assets increases by preparing new deeds of gift and loan contracts (at nominal cost).

Frequently Asked Questions

Do we have to transfer money?

No. Often gift-and-loan-backs are “book transactions” – that is, the parties sign the necessary documents, but money does not actually change hands. However, the strategy is legally stronger if the gift and loan amounts are transferred between relevant accounts.

I already have a mortgage on my property. Can I gift-and-loan-back?

Yes. If you have already mortgaged your property, you can still prepare and sign a second mortgage to secure the loan-back. The separate entity can hold the mortgage document and register it only when needed to avoid any potential breach of the first mortgage.

Another option is to contact your bank and get their permission to lodge a second mortgage. While the bank may charge a small amount for new paperwork, they very rarely reject such requests. You could then lodge the second mortgage and have full protection.

Does my trust need a corporate trustee?

No. However, it is common practice and we strongly recommend you have a company as trustee of the discretionary trust created for your gift-and-loan-back.

A trustee is liable for their trust’s liabilities. If the owner is trustee, the owner’s assets (including the asset to be protected) are exposed to claims against the trust.

If a company is trustee, only the company’s assets are exposed (that is, assets held in its own name, not the company as trustee). There is no need for the company to hold assets in its own name, reducing or eliminating exposure.

Corporate trustees have other advantages:

- They exist indefinitely (unlike individual trustees who will eventually pass away).

- Legal ownership of the trust’s assets does not change when the directors or shareholders of the corporate trustee change (unlike individual trustee where legal ownership changes when individual trustees change.

- The shareholders of the corporate trustee can effectively control the trust by appointing the directors of the corporate trustee.

- As mentioned above, exposure is limited to the assets in the corporate trustee’s own name. The ordinarily liability protections of a company shield the assets of the directors and shareholders.

- Companies have access to tax rates and options that are not available to individuals.

Can gift-and-loan-back transactions be reversed under “clawback” provisions?

Maybe. Under the Bankruptcy Act 1966 (Cth) a gift-and-loan-back may be reversed (or “clawed-back”) in the event of a bankruptcy or insolvency claim.

A gift-and-loan back is best considered and actioned as a pre-emptive step “when the seas and sailing is smooth”. Judges, including the High Court, have long agreed that transactions done when a party’s financial position was sound were not done with an intent to defraud creditors.

Time frames apply to actions done in anticipation of bankruptcy or insolvency. If a gift-and-loan-back happens too soon before insolvency, debtors can sometimes “claw-back” the asset or money. Generally, the more time between gift-and-loan-back and insolvency, the less likely it will be reversed.

Summary

Depending on your situation, a gift-and-loan-back may provide an effective method of protecting equity in assets without incurring transfer duty and other taxation consequences.

Contact Us

Need more information or want to book in a time to talk with one of our experts? Just fill in the form below and we'll get back to you.

Further Resources

NDAs and Contamination

Latest Videos

Businesses that we have helped

Here's a small selection of businesses we've helped achieve great outcomes.

As Featured In: